Enhancing Cash Flow with QuickFee’s Flexible Pay Over Time Options

QuickFee Pay Over Time is an easy way to take control of your operational costs, while helping customers manage their own expenses. Just send a payment plan quote anytime to make your services more affordable.

Best of all? Your business will always get paid in full and upfront.

Control cash flow with a simple financing option.

Have your customers ever asked for more time to pay? Now you can answer that question with a payment plan quote!

Choose to offer financing plans in 3, 6, 9, or 12-month terms. You control exactly who is eligible for a payment plan (and how long they have to pay down their balance.)

Key Benefits:

Smooth over your cash flow. Get paid upfront every time when customers can choose low-interest financing.

Spend less on collections.

It shouldn’t take months to get paid for your work. Cut down on collections with payment plans.

Close faster with prospects. With access to funding, customers are more likely to buy all the services they need.

Secure, reliable funding.

All payment plans go through a secure payment portal where you can review and approve.

Trusted for financing solutions since 2009:

Service providers worldwide

Average reduction in overdue payments

Funded for customers

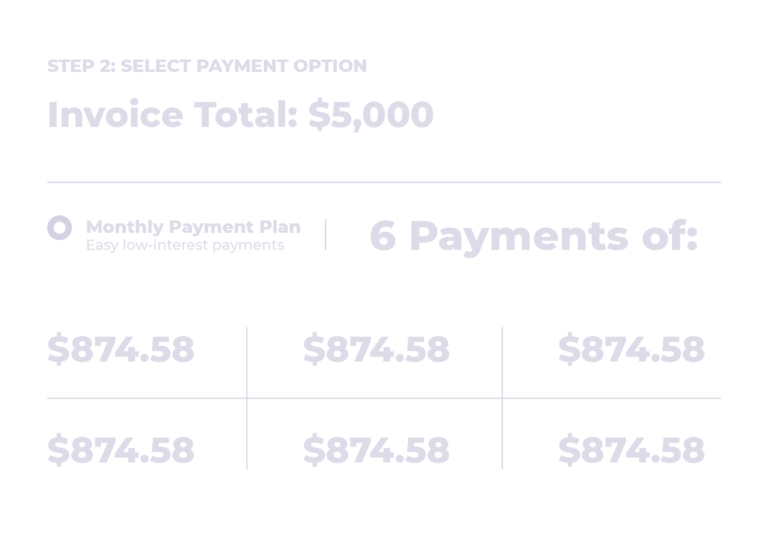

How does Pay Over Time work?

Allow customers to request payment plans directly from your payment portal or generate quotes on a case-by-case basis: It’s up to you!

To create a payment plan, just enter information in your QuickFee account and send the quote to your customer.

Your customer can accept the payment plan offer manually or electronically, using our convenient form.

Once your customer is approved and accepts the terms, the full amount arrives in your bank account within a few days.

Remove barriers for your customers to pay you.

Thousands of professionals use QuickFee Pay Over Time to help their customers with cash flow and save on collections.

Here’s what our customers say:

Here’s what our customers say:

Carbon Group

When new clients had the option to fund our initial work, it removed major barriers during the onboarding process. It allowed us to close clients quicker - which in turn allowed us to win more business.

Jamie Davison

Co-FounderFrazier & Deeter

Most of our clients have taken a 3 or 6-month option at nominal interest. QuickFee's really been helpful with us to erase the painpoint of collection issues.

Shawn Fowler

CFOMcSoley McCoy & Co

One client used to take up to 8 months to pay... but when they used QuickFee I received payment within 1 day. We are absolutely loving the invoice platform and the payment plan options.

Michele Eaton

ControllerA strong support team for payment plans:

+ Dedicated QuickFee specialist to help you generate payment plan quotes, reach out to late payers, or answer questions

+ Complete starter kit with marketing materials and resources

+ No additional time, costs, or setup to start offering payment plans