A Practical A/R Automation Guide for Accounting Firms

Firms in the accounting and finance sector often underestimate the value of optimizing their Accounts Receivable (A/R) before the end of each fiscal year. This means year-end can often be a frantic and frustrating time for staff. Late or delayed payments also pose significant setbacks to the firm’s financial health in the long run.

The solution? Creating efficient payment processes to streamline your A/R effortlessly, year-round. By minimizing your firm’s manual payment activity, you can reduce aging A/R faster and enhance cash flow, saving revenue for more critical investments.

For 3 use cases showing how firms are cleaning up their A/R processes before the end of the year – watch our on-demand webinar on this topic. Or, keep reading this guide to learn how efficient payment processes can transform your firm.

Understand the Impact of Overdue Payments on ROI

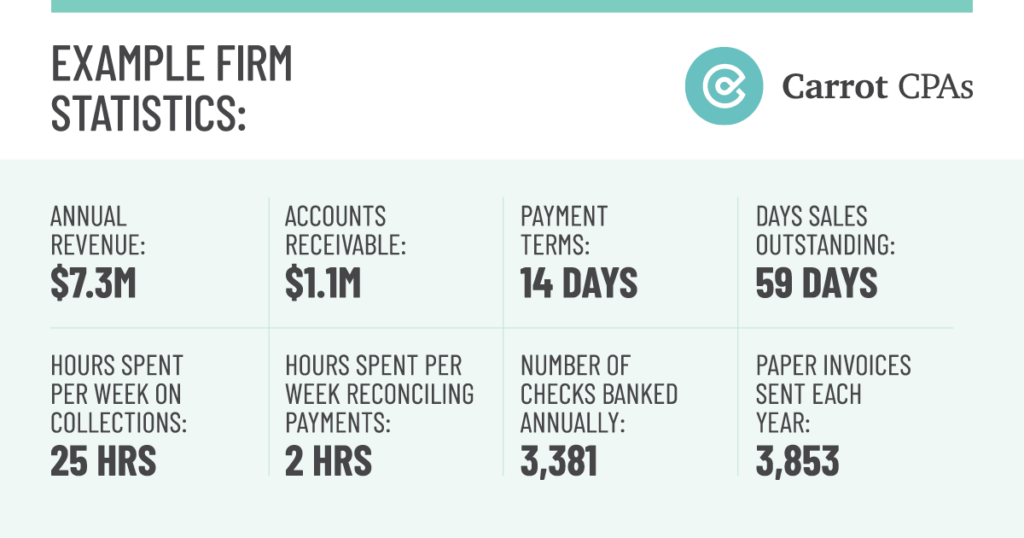

Before we dig into best practices for efficient payment processes, it’s important to understand the impact on ROI from not addressing overdue payments. Consider, for example, an accounting firm that generates an annual revenue of $7.3 million and has $1.1 million in Accounts Receivable. Let’s assume that the payment terms are “due upon receipt” and the invoice takes about two weeks to reach the client.

The firm also primarily uses manual payment processes and dedicates 25 hours to collections and 2 hours to reconciling payments every week. Checks account for a majority of the client payments in this firm as well, with 3,381 processed annually.

Did you know? During our webinar on how to clean up Accounts Receivable, 44% of participants said they had 30-day payment terms, with 39% using due upon receipt. But the actual average DSO for most accounting firms is 47 days or more.

Even at a glance, it’s easy to see the impact this would have on the firm’s long-term ROI. By automating low-value tasks related to cash collections and eliminating 27 staff hours per week, the firm could potentially save 187.2 business days each year.

The 187.2 business days saved by automating low-value tasks can be redirected towards higher-value activities. (This doesn’t mean job cuts – it’s about liberating staff to concentrate on and deliver on more meaningful tasks.)

Reducing Days Sales Outstanding for Increased Revenue

One of the most important A/R metrics to watch is Days Sales Outstanding (DSO). This refers to the average number of days it takes for a company to collect payment after a sale. Let’s assume that in our example, the firm’s DSO is 59 days, despite having net payment terms of 14 days – showing the significant and ongoing delay in payment collection.

The delay leaves a large amount of money in the clients’ bank accounts instead of the firm’s coffers. Looking even closer at the numbers, the firm is missing out on an estimated $909,986 being in their bank, just because of payment delays and inefficient processes.

This $909,986 loss results from the difference between invoice issuance and payment receipt, as the firm’s average revenue per day is $20,000 (annual revenue, divided by the 365 days in a year). That’s almost $1 million that should be in the firm’s bank account.

In summary, just by promptly addressing overdue payments and prioritizing DSO reduction, this example firm could save nearly a million dollars, on top of freeing up substantial time.

Eliminating Soft Costs and Processing Fees

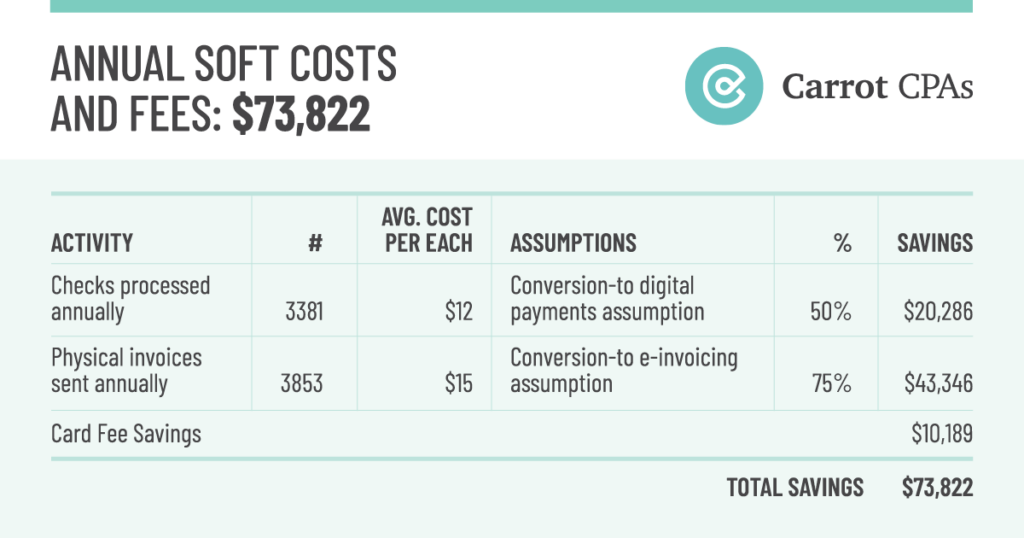

Traditional payment processing methods, such as checks and physical invoices, are also expensive. Let’s go back to our example firm processing 3,381 checks per year. If each check costs an average of $12 to process, the firm could be spending up to $20,286 just on checks annually.

Similarly, the annual cost of sending out physical invoices can be as high as $43,346. By switching to digital payment options and automated invoicing, these two costs can be lowered dramatically. Many firms also see an immediate reduction of $10,000 or more after transitioning to a digital payment platform and passing credit card surcharges through to the client.

Print invoicing also incurs costs for paper, ink, and postage. It incurs more significant indirect costs like employee hours for data entry and manual mailing – and you can expect to pay $50 or more to resolve any printing, processing, or reconciliation errors.

Of course, having a more efficient process does even more than just help save costs:

- It can enhance the employee experience by eliminating low-value payment processing tasks.

- It can minimize the risk associated with delayed payments and aging receivables.

- It makes paying simple, convenient, and straightforward for clients – elevating their perception of your brand.

Clearing the Way for Efficient Payment Processes

Manual payment procedures can lead to errors and inconsistencies in your firm’s tracking systems. It demands considerable manpower to maintain these systems, which can further impact payment collection delays. This is why it’s critical to evaluate your manual processes for payments – and then replace them with more efficient options wherever possible.

The most common challenges with manual payment processes:

- Slow, late, or failed payments

- Errors and data inconsistencies

- Less liquidity in the firm

- Time spent on manual, tedious tasks (rather than high-value projects)

- Limited visibility in your client management or practice management systems

The two best ways to overcome these challenges:

- Offer online payment options: Ensure that all your invoicing and payment processes are easily accessible online to improve client satisfaction and speed up payments.

- Implement automation that syncs to your practice management system: To speed up payments further, use automation that will reconcile everything back to your practice management system. When it’s easy to send and track invoices digitally, your clients will get a simple, end-to-end payment experience that actually encourages them to pay in a timely manner.

How to Boost Cash Flow with Quick Fee

Streamlining Your Accounts Receivable and Payment Processes

QuickFee provides an effective solution that enhances cash flow and streamlines Accounts Receivable. With a product suite focused on A/R reduction, process automation, and cost-savings, it’s easy to start seeing more meaningful ROI on your firm’s activities.

The QuickFee A/R optimization platform includes:

- Modernized Digital Payments with Pay Now for affordable ACH and card processing in your firm’s online payment portal,

- Exclusive Client Financing with our Pay Over Time option to give your clients payment plans over 3, 6, 9, or 12 months, and

- A/R Automation with QuickFee Connect for purpose-built automation that integrates with your existing practice management system.

Why firms work with QuickFee:

- They want to Reduce A/R – A/R is typically the #1 item on a firm’s balance sheet, and we help turn that A/R into cash.

- They want to Grow their Business – there are many priorities competing for cash, and we can help find more of it for firms and their clients.

- They want to Automate their Processes – we increase efficiency while improving the client and employee experience.

- They want to Save on Fees – stop spending money on credit card fees by reducing or eliminating merchant fees altogether.

Give Clients the Flexibility to Pay Over Time

QuickFee Finance is a client financing option exclusive to QuickFee, which enables accounting firms to provide their clients with monthly payment plans over 3, 6, 9, or 12 months. This smooths client cash flow while bolstering firm cash flow at the same time.

(Plus: this program doesn’t impact the client’s credit report, making it much more affordable and hassle-free than seeking new sources of credit.)

Monthly payment plans are also an effective strategy for managing A/R and fostering growth. This is because they allow clients to budget their payments. Consider a client who is looking for advisory services, in addition to tax work. Your firm provides a quote, but the client can’t afford the upfront cost. Offering a monthly payment plan allows the firm to break down the cost into manageable payments – making services more affordable for the client.

Monthly payment plans can also help firms secure new business. Offering flexible payment options differentiates firms from competitors and attracts more clients. This is crucial in the competitive business environment where firms compete against each other and the client’s budget.

Want to know what your clients really think about payment plans? Check out our Payment Plan User Survey report here.

Start Improving ROI and Simplifying Processes Today!

In the fast-paced digital era, all businesses must adopt proactive strategies to ensure their financial health and growth. These include efficient payment processes, automated solutions, and flexible payment options. The right blend of these strategies can lead to improved ROI and long-term business success.

Contact us here to learn how QuickFee can help. Or, watch our on-demand webinar for a deeper dive on the concepts addressed in this guide.