Discover a simple client financing solution exclusive to QuickFee. Get paid upfront every single time to reduce aging Accounts Receivables and smooth your cash flow – all while giving your clients the flexibility to pay over time.

There’s no cost to your firm. Plus: with access to funding, clients are more likely to buy all the services they really need.

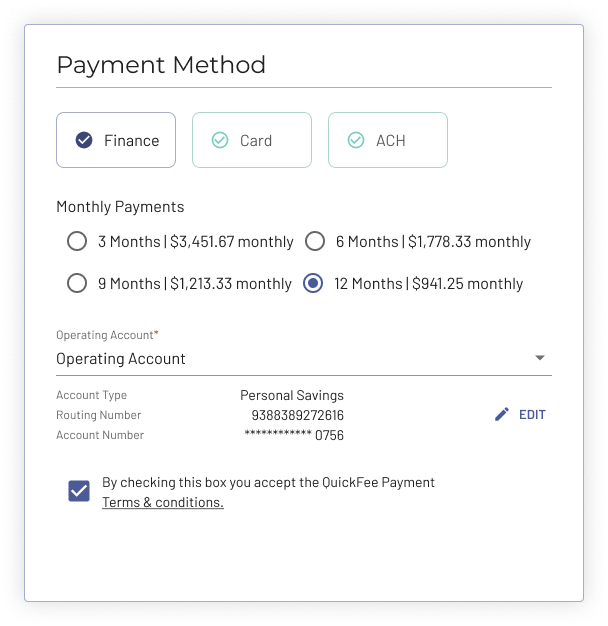

Have your customers ever asked you for more time to pay? Now you can answer that question with a low-interest payment plan quote over 3, 6, 9, or 12 month terms. You control exactly who is eligible for a payment plan (and how long they have to pay down their balance.)

Smooth over your cash flow.

Get paid in full every time when customers can choose low-interest financing.

Spend less on collections.

It shouldn’t take months to get paid for your work. Reduce aging Receivables with a financing option.

Secure, reliable funding.

All payment plans go through our secure payment portal where you can review and approve them.

Generate more revenue.

With access to funding, your clients are more likely to buy all the services they actually need.

Professional service firms are often very generous about late client payments. But as Gene Godick at G-Squared Partners, LLC shares in this video testimonial, it’s important to protect your firm’s cash flow too! Here’s how QuickFee Finance helped G-Squared win while still supporting their clients.

When you start offering a financing option, you have two easy options: 1) Let clients request financing plans directly from your QuickFee portal, or 2) you can send them a payment plan quote generated by your team or your QuickFee Relationship Manager. Here’s how it works:

To create a new payment plan, just enter information in your QuickFee account and send the quote to your client.

Your client can accept the payment plan offer manually or electronically, using our convenient form.

Once your client is approved and accepts the terms, the full amount arrives in your bank account within a few days!

Thousands of professionals use QuickFee Pay Over Time to help their customers with cash flow and save on collections.

QuickFee’s been a lifesaver for us…They’ve helped us with ACH fees and Credit Card charges, and then also payment plans for our clients. Most of our clients have taken a 3 or 6-month option at nominal interest. It’s really been helpful for us to erase the pain point of collection issues.

Shawn Fowler, CFO

Since partnering with QuickFee, our firm has seen significant savings on credit card processing fees with the option to pass a nominal credit card surcharge to the clients. We realized approximately $140,000 in savings last year thanks to QuickFee. Our clients appreciate the ability to pay online with multiple payment options including ACH, credit card, or signing up for QuickFee Finance - an easy, no hassle way to spread the payment of their invoices over time!

Reyne Dvorak, Chief Revenue Officer

Since working with QuickFee, we have been able to not only bridge the gap in Accounts Receivable collections but start additional work a client is holding on because of cash flow and budget constraints. A $50,000 investment in accounting and tax planning becomes very affordable by offering a 12-month payment plan.

Nicholas S. Libock, Managing Member

In just a short time, QuickFee’s financial solutions have given our clients the freedom to pay over time and get caught up on their invoices. It has been an easy transition for both our company and our clients. Thank you QuickFee for making this possible. We look forward to our continued partnership!

Victoria Klee, Administrative Assistant

QuickFee allows us to receive the full influx of capital on the transaction upfront while offering our clients the ability to break up their payments over time. A member of our sales team told me that around 25% of people inquire about a payment plan...this is going to be a real game changer for us.

Jaime Franco, Director of Administrative Services

One client used to take up to 8 months to pay... but when they used QuickFee I received payment within 1 day. We are absolutely loving the invoice platform and the payment plan options.

Michele Eaton, Former Controller

We value QuickFee and the payment solutions provided. The client is happy to spread their total service over time. We are very pleased to receive our total Accounts Receivable for the client (within a reasonable time of the client agreeing to terms.) As a bonus: Because the client pays QuickFee, collection reminders to clients have also been dramatically reduced.

Nicholas S. Libock, Managing Member

We believe that payments are being made by our clients quicker. QuickFee combines great customer service with a great selection of payment options - all at low fees for our company.

Brian Wages, Credits and Incentives Specialist

Other financing options will require your clients to get a credit check, or fill out a lengthy application. With QuickFee Finance, there’s no need: They get funded directly and immediately as soon as you approve the payment plan in your portal.

Don’t wait to improve your cash flow and generate more revenue! Find out how QuickFee Finance can help your firm grow today.

Our Mission

QuickFee helps professionals manage receivables and get paid for their work faster. With one convenient platform, professional service firms can accept online payments, offer financing, and manage client invoices.

Contact Us

(844) 968-4387

support@quickfee.com

Mailing Address

5601 Democracy Drive, Suite 205

Plano, TX 75024