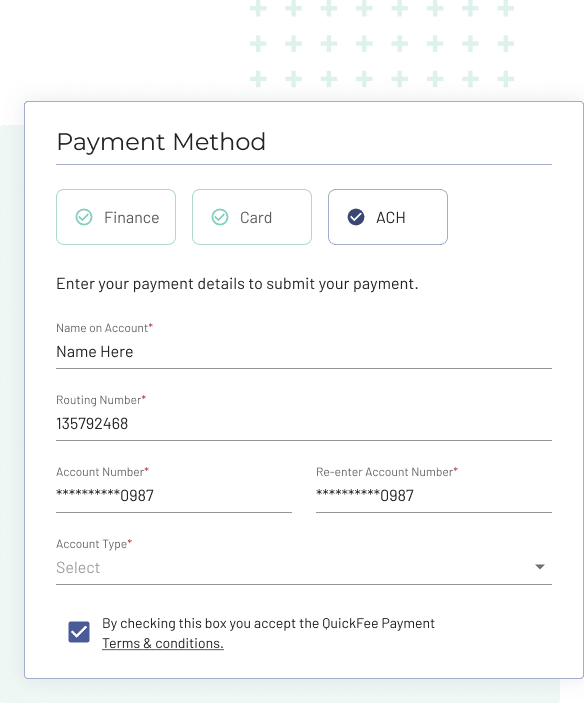

Everyone likes having convenient options. Make your payment processing seamless (and affordable) with Pay Now. Your clients always get the choice to pay by ACH/EFT, Card, or set up recurring payments.

It includes all the digital payment options you love, minus the confusing charges or costly credit card fees.

Amazing things happen when your payment process gets un-complicated. By accepting Card and ACH payments from one portal, you’ll get paid faster and improve your cash flow over time. (You’ll also spend less time on manual data entry.)

No fees necessary.

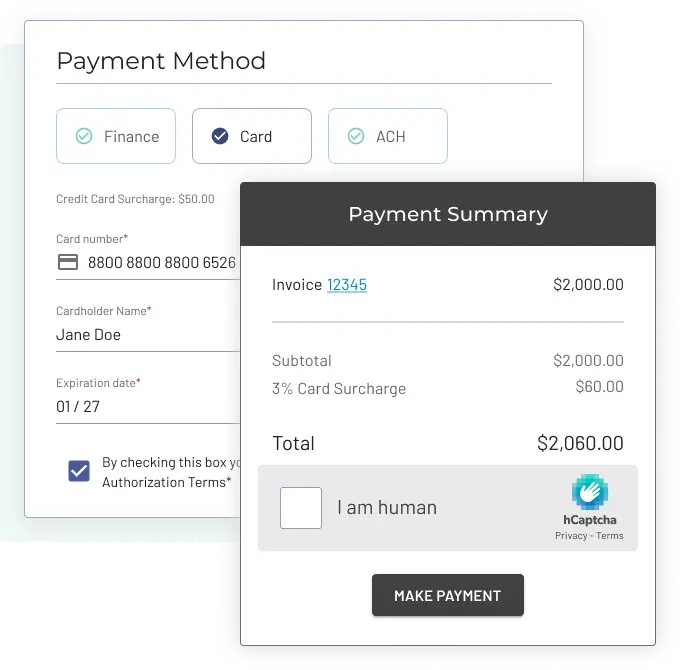

Say goodbye to costly merchant fees with credit surcharging to the client.

No caps on ACH.

You read that right – no limits on ACH processing (or invoice maximums.)

One easy payment link.

Keep it simple with one payment link to securely accept credit, debit, or ACH.

Accelerated payments.

Add your payment link to QR codes, emails, and invoices to get paid faster.

Security first.

We protect you and your clients with secure and reliable online payments.

With QuickFee, you can also set up recurring monthly ACH or Card payments, right from your Pay Now portal. Recurring billing adds convenience for your regular customers – and creates a more predictable revenue stream for your business, too.

QuickFee Pay Now can be customized to meet the needs of your firm and help you achieve your business growth and A/R reduction goals. Whether you’re looking to accept ACH, debit, credit card, or all of the above, our experts can help you get started within just a few days!

After signing up, you’ll get a custom payment portal link to share with your clients.

Our payment and financing experts will assess your needs and walk you through best practices.

Start accepting payments anywhere – your website, engagement letters, invoices, emails, and more!

Tired of paying merchant service fees for your credit card provider? QuickFee Pay Now makes it incredibly easy to pass the surcharge onto your client, saving you thousands annually on your payment service. And it’s available in almost every state in the U.S.

QuickFee’s been a lifesaver for us…They’ve helped us with ACH fees and Credit Card charges, and then also payment plans for our clients. Most of our clients have taken a 3 or 6-month option at nominal interest. It’s really been helpful for us to erase the pain point of collection issues.

Shawn Fowler, CFO

Since partnering with QuickFee, our firm has seen significant savings on credit card processing fees with the option to pass a nominal credit card surcharge to the clients. We realized approximately $140,000 in savings last year thanks to QuickFee. Our clients appreciate the ability to pay online with multiple payment options including ACH, credit card, or signing up for QuickFee Finance - an easy, no hassle way to spread the payment of their invoices over time!

Reyne Dvorak, Chief Revenue Officer

Since working with QuickFee, we have been able to not only bridge the gap in Accounts Receivable collections but start additional work a client is holding on because of cash flow and budget constraints. A $50,000 investment in accounting and tax planning becomes very affordable by offering a 12-month payment plan.

Nicholas S. Libock, Managing Member

In just a short time, QuickFee’s financial solutions have given our clients the freedom to pay over time and get caught up on their invoices. It has been an easy transition for both our company and our clients. Thank you QuickFee for making this possible. We look forward to our continued partnership!

Victoria Klee, Administrative Assistant

QuickFee allows us to receive the full influx of capital on the transaction upfront while offering our clients the ability to break up their payments over time. A member of our sales team told me that around 25% of people inquire about a payment plan...this is going to be a real game changer for us.

Jaime Franco, Director of Administrative Services

One client used to take up to 8 months to pay... but when they used QuickFee I received payment within 1 day. We are absolutely loving the invoice platform and the payment plan options.

Michele Eaton, Former Controller

We value QuickFee and the payment solutions provided. The client is happy to spread their total service over time. We are very pleased to receive our total Accounts Receivable for the client (within a reasonable time of the client agreeing to terms.) As a bonus: Because the client pays QuickFee, collection reminders to clients have also been dramatically reduced.

Nicholas S. Libock, Managing Member

We believe that payments are being made by our clients quicker. QuickFee combines great customer service with a great selection of payment options - all at low fees for our company.

Brian Wages, Credits and Incentives Specialist

Want to learn more about Pay Now? See our seamless ACH and credit card processing options in action.

Our Mission

QuickFee helps professionals manage receivables and get paid for their work faster. With one convenient platform, professional service firms can accept online payments, offer financing, and manage client invoices.

Contact Us

(844) 968-4387

support@quickfee.com

Mailing Address

5601 Democracy Drive, Suite 205

Plano, TX 75024